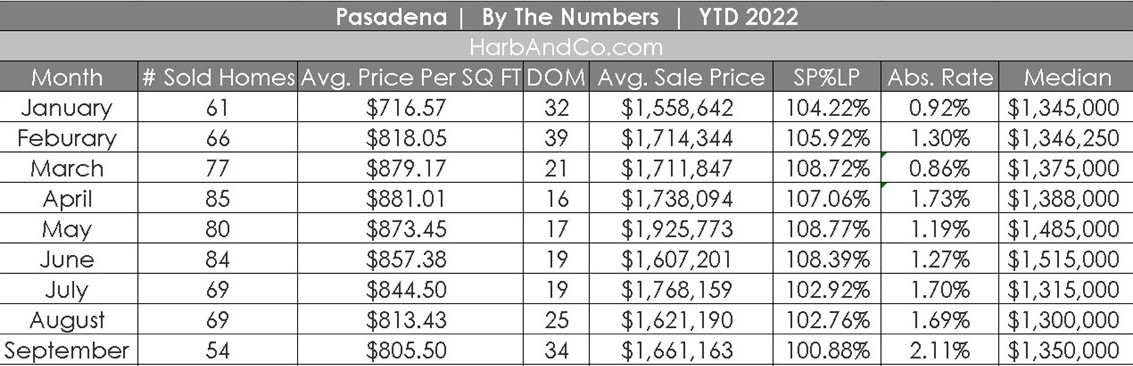

Our Pasadena housing market update for September 2022 reflects the changes in the Pasadena market. There were just fifty-four sales, the lowest number year to date. Days on the market (DOM) were longer than the past six months. Last month twenty-seven homes sold over asking, three at asking, and twenty-four below asking.

The least expensive home sold in Pasadena was a two-bedroom, one-bathroom, 1,170-square-foot home located at 1431 Villa St. It was listed for $799,000 and sold in twenty-eight days for just $700,000. The most expensive sale was a six-bedroom, seven-bathroom, 6,270-square-foot home at 312 S. Grand Ave. It listed for $4,995,000 and sold for $4,850,000 in ten days.

The selling price to list price ratio is the lowest of the year. The absorption rate is the highest for the year. The lowest price per square foot was $416.88 for a two-bedroom, two-bath 1919 square foot home. The highest price per square foot was for a two-bedroom, one-bath, 832-square-foot home.

This is from a newsletter from Floyd Walters, owner of La Canada’s BWA Mortgage:

How Higher Mortgage Rates Might Impact Home Prices

Let me be the first to say that it’s still too early in this shifting market to accurately predict exactly how things will shake out. What we do have is some interest rate data. And we have some experience in changing markets that we can apply.

For example, if a first-time home buyer was looking to purchase a home back in April of this year, they would have been looking at mortgage rates in the 4.25% range, and the Los Angeles County average purchase price was $850,000. If that borrower had put 10% down, their new mortgage payment would have been about $3,763 per month.

If that same buyer purchased that same home today, assuming no price adjustment to the home, with the current mortgage rate in the range of 6.25%, their payment would be about $4,710 per month. An increase of $947 per month.

Now, there are lots of options here. For example, the buyer could pay the extra $947 per month and be done with it. Since there has been a lack of inventory, they may do just that. On the other hand, human nature may kick in here and say, “hold on, “…” that’s a lot of money,”… “what are my alternatives?”

One alternative would be to buy a less expensive home in hopes of getting a mortgage payment closer to what they would have gotten in the spring. To do that, you would need to lower your purchase price down to about $725,000 (about a 15% drop). They might also choose not to buy right now, but rent prices are on the rise, and I don’t see that changing a lot. So while some will choose this option, it may not be the best option for long-term planning.

What may happen is a combination of home buyers willing to pay a little higher payment (since most home buyers probably got a pretty good raise this year) and home sellers thinking about taking a little lower price than they had hoped for, knowing that rates have moved up and traffic coming through their home may be down a bit.

Related Post: 312 S. Grand Ave. Pasadena, most expensive Pasadena sale