Let’s examine the Pasadena real estate market for August 2024. Thirty-three of the fifty-five homes sold over their asking price. Three at the asking price and nineteen less than asking. A five-bedroom, three-bathroom home at 817 N. Euclid Ave sold for $501.41 per foot. A two-bedroom, one-bathroom home at 780 N. Craig Ave. sold for $1,493.90 per foot.

Last month, the least expensive home sold in Pasadena was a one-bedroom, one-bathroom, 2,059-square-foot located at 461 N. Garfield Ave. This property was listed for $619,000 and took forty-one days to sell for $620,000. The most expensive home sold in Pasadena was a four-bedroom, six-bathroom, 5,995-square-foot home at 1140 Chateau Rd. The seller listed the home for $7,500,000 and sold it for $6,400,000.

Two homes sold off the market: the one on Chateau noted above and one at 611 Highland Ave. Ten homes sold in twelve days or less. Three homes sold in more than eighty days. One Pasadena home sale on Encino sold after 583 days on the market.

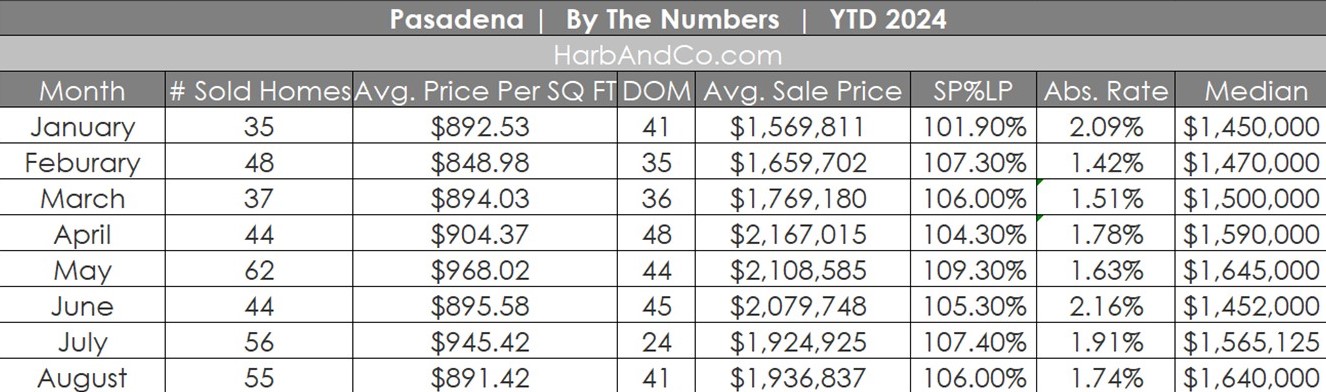

The absorption rate remains low, reflecting a strong seller market in Pasadena.

From Corelogic:

High mortgage interest rates continue to challenge the housing market

Homebuyers are increasingly stretched to buy a home, and some existing homeowners are feeling the pressure of higher homeownership costs and missing their mortgage payments. Overall, there is more caution in the housing market as housing indicators continue to revert to pre-pandemic trends and both buyers and investors carefully evaluate their option. Here is where the current landscape stands right now:

As of July 2024, the share of first-time home buyers (FTHB) remained around 37%, which is the same as the year prior. The share of U.S. FTHB applications surged to 39% in 2020, up from about 35% in 2019. However, the FTHBs share dropped to 34% during the third quarter of 2022, a three-year low, as mortgage rates at the time surged to the highest level in almost 25 years. The increase in the share of mortgage applications among the FTHBs since 2022 reflects fewer move-up buyers in markets as homeowners remain locked in with historically low mortgage rates.