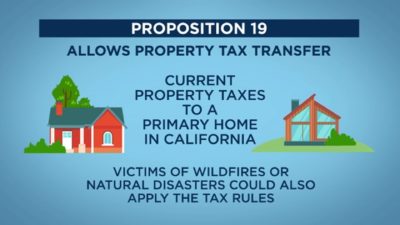

Proposition 19’s Passage and its Impact: Proposition 19 allows Seniors (those 55 and over), the disabled or those displaced by victims of natural disasters to blend the existing property tax base of their current home with the purchase of another more expensive home. This removes a prior obstacle for seniors who want to move nearer to family. Or those wanting single level living but in more expensive neighborhoods.

Proposition 19 allows three transfers in a lifetime. The disabled, those displaced by natural disasters and California Seniors no longer need to hesitate to sell their current residence, knowing, they can take their tax rate through a total of three moves. In addition, it no longer applies only to participating California counties but to all of California.

Previously, qualifying parties could only transfer their property tax rate when the replacement property was less expensive than their current home. And in a participating California county. Proposition 19 removes this barrier. It allows them to buy a more expensive home and transfer their current property tax rate with an upward adjustment.

Proposition 19 also closes an inherited property tax loophole that some felt unfair. Previously, if you inherited property you also inherited the property tax rate. Now, when you inherit a home and use it as your primary residence you can retain the original tax rate. However, if used as a second home or rental, the home is reassessed at current market value.

For exact information pertaining to proposition 19’s passage and its impact, consult a CPA or tax professional.

Related Post: Understanding supplemental property taxes

Saving on capital gains

We have decided not to move many times for this very reason. Always afraid to use up our one time move for fear it would be needed more later in life. So this is great for us. Time to find a one story!!!