Seller financing is also referred to as a seller carry back. Likely due to my banking background I believe there are many pitfalls to seller financing.

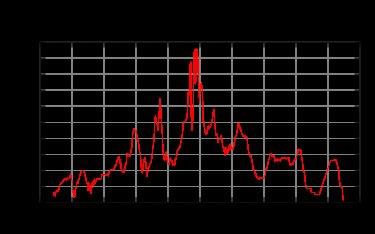

As interest rates are cyclical, the benefits of seller financing increase when rates are high. When I first started in banking, interest rates were around 5%. When I worked for Allstate Saving and Loan, rates later peaked at about 21%. Experiencing firsthand how interest rates fluctuate over the years, I would never lend long term money to a stranger at today’s low interest rates.

The only reason a seller should consider carrying a note today would be for tax purposes such as offsetting capital gains. In that instance I suggest they consult with their CPA in order to determine if the tax benefit outweighs the risk. Because of today’s low interest rates, why would a buyer want a home seller to finance their purchase? Due to the banks rigorous underwriting standards, perhaps the buyer doesn’t qualify. Unless the down payment is substantial, why would a home seller consider a loan to a borrower whom the bank doesn’t deem creditworthy?

There are numerous pitfalls to seller financing:

- If the buyer stops making payments can the seller financially survive without this income? They will need to foreclose which is a costly legal process and takes about four months. In the event the buyer fights the foreclosure, it could be much longer.

- By the time the foreclosure process is completed, real estate values could be higher or they could be lower.

- In the event of foreclosure, there is no guarantee what the condition of the home will be by the time the home seller obtains legal possession.

Related Post: Pros and Cons of Seller Carry Backs