With higher interest rates, your Fico score is more important than ever. What is a good Fico score?

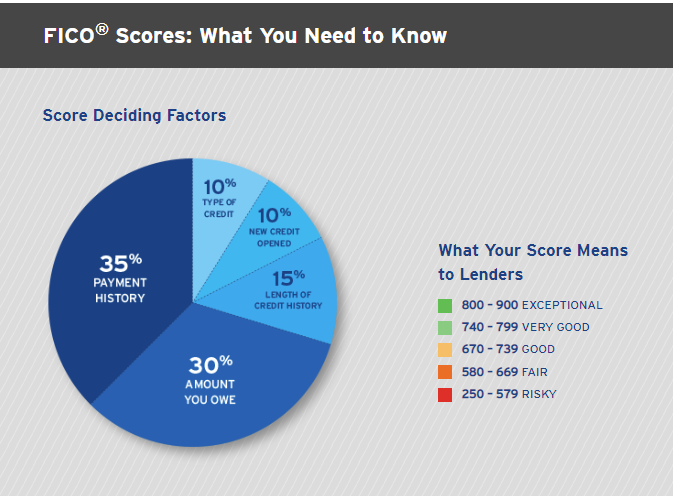

Your Fico score is a numerical representation of your credit. Creditors report your payment history to credit bureaus. An algorithm then assigns numerical values to each item on your credit report. Positive points are attributed to on-time payments, type of credit, etc. Accordingly, you get negative points for late payments, too many recent accounts, etc.

Creditors assume the higher your score, the less risky you are as a borrower. To obtain the best mortgage interest rate, your FICO should be at least 760.

When shopping for a mortgage, you will obtain a better interest rate with a higher FICO—looking to boost your score? Paying on time is critical. However, you can increase the score by contacting your credit card holders and improving your credit limit. For example, your monthly bill could be high if you typically use your credit card for gas, groceries, etc. If the total amount owed is near your credit limit, that can adversely affect your score. Ideally, the amount you owe should not exceed 30% of your limit.

Related Post: How to boost your Fico score

It’s so much easier to monitor your credit score now a days. It used to be this mysterious number you only found out about when you applied for a loan and the lender might tell you if you asked. Today I am offered ways to monitor my score online from every bank I use. And it’s free!